Skip the Crystal Ball: Real Insights Are Hiding in Plain Sight

A Winery Guide to Available Research

You know what’s better than spending ten grand on a focus group where Jan from accounting tells you your wine label “feels aggressive”? Doing your homework first. And no, we don’t mean journaling your feelings over a glass of Pinot. We mean secondary research—the overlooked, underloved MVP of marketing insight.

While everyone else is out there reinventing the wheel with a clipboard and a budget they don’t actually have, smart marketers are quietly unlocking industry goldmines using data that’s already been collected. It’s like discovering your neighbor’s Wi-Fi is open and they happen to stream all the same shows you like—only more legal.

Let’s break down this not-so-secret weapon.

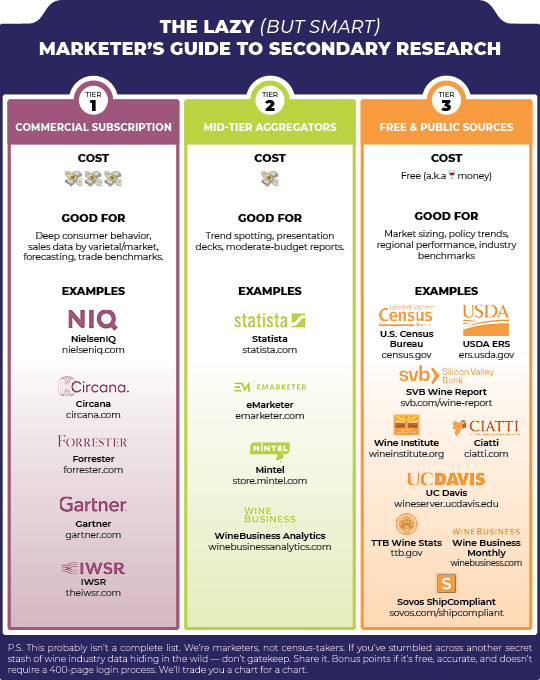

The Bougie Stuff: Commercial Subscription Data

If you’ve got champagne dreams and a caviar budget, welcome to the gated community of NielsenIQ, IRI, Forrester, and Gartner. These firms offer beautifully packaged data dashboards that track everything from how Sauvignon Blanc is trending in Boise to whether Gen Z is ghosting Google Shopping.

Want to see how your Cabernet stacks up nationwide? Nielsen’s retail scan data can show that—across regions, stores, or even by bottle size if you’re into that sort of thing. Forrester? They’ll tell you how TikTok is reshaping wine buying behavior while your cousin is still trying to get a post to go viral.

Use this if: You’re selling wine in more than one zip code and your accountant doesn’t flinch at four-figure invoices.

Fun Fact: The global wine market is projected to grow to $528 billion by 2028, and commercial providers are the first to spot the signals of who’s driving that growth (Statista, 2024).

The Budget-Conscious Binge: Affordable Aggregators

Don’t have Kardashian-level cash? No problem. Enter Statista, eMarketer, and Mintel Snapshots—the Netflix of marketing data. For a few hundred bucks, you get enough charts to wallpaper your entire pitch deck. Plus, Statista’s infographics make it look like you know what you’re doing, even if you’re pulling this together during your third espresso.

You won’t get the granularity of custom tracking, but you will get reputable, vetted data summaries from a buffet of sources. Enough to sound smart in meetings? Absolutely.

Use this if: You’re a small-to-mid-sized winery with a solid curiosity streak and a limited research budget.

Stat to Steal: As of 2023, 34% of U.S. wine drinkers said they frequently consult online sources before choosing a wine (Wine Intelligence, 2023 via Statista).

The Glorious Free-for-All: Public Data Sources

Ah yes, the thrift store of research—where the savvy find gems and the lazy get overwhelmed. We’re talking U.S. Census Bureau, USDA, Bureau of Labor Statistics, and even local chambers of commerce. Want to know how many millennials live within driving distance of your tasting room? The Census has you covered. Curious what tourists are spending per visit in your AVA? That’s probably buried in some dusty PDF from the regional tourism board.

Then there’s industry gold like the Silicon Valley Bank State of the Wine Industry report, academic studies from UC Davis, and that one random Cornell paper you found while Googling “why don’t Gen Z drink Merlot.”

Use this if: You’ve got time, patience, and the ability to read past the executive summary.

Hot Tip: The 2024 SVB report warns that wine consumption is declining among younger adults—and we all know ignoring Gen Z is a long-term losing strategy.

The Point: Work Smarter, Not Just Louder

Secondary research won’t tell you what your tasting room visitors think of your new cheese board. But it will help you figure out whether they’re part of a national movement toward charcuterie minimalism (yes, that’s a thing). It can also save you from investing in a new canned wine line just as the trend crests.

And let’s be honest—if you’re going to try to sell $48 rosé in a market flooded with $12 competitors, you better have data to back up your magic.

TL;DR (But You Really Shouldn’t)

Secondary research is not optional homework—it’s the strategic shortcut no one talks about enough. It’s fast, often free, and when done right, it’s your best bet at making marketing decisions that don’t come back to haunt you.

So before you start commissioning focus groups, maybe spend a few hours Googling, downloading, and spreadsheeting your way into brilliance.

Or just call us. We already did the reading.

P.S. This probably isn’t a complete list. We’re marketers, not census-takers. If you’ve stumbled across another secret stash of wine industry data hiding in the wild—don’t gatekeep. Share it. Bonus points if it’s free, accurate, and doesn’t require a 400-page login process. We’ll trade you a chart for a chart. 🍷📈