Crushing It With Data:

A Winery’s Guide to Primary Research

One standard marketing principle is “Don’t market to yourself.” In other words, just because a message or strategy makes sense to you, it does not mean it will resonate with your audience. We are human, and it is easy to fall into the trap of viewing the category, consumer, or competitive set in a way that may be informed but not relevant to the marketing challenge ahead. For instance, you may be considering Chardonnay as your competition, but consumers are making purchase decisions between your Chardonnay and all white wines on the shelf under $15. Talking directly to your customers is invaluable for confirming theories and aligning your messaging. Conducting research yourself—directly and intentionally—is often the most reliable way to avoid internal bias and align your strategy with actual consumer perspectives.

One of the most accessible and common forms of primary research for wineries involves reaching out to their wine club members. Many wineries conduct Wine Club member surveys periodically to ensure their club benefits remain current with trends and align with members’ evolving interests. Some smart wineries also survey former members with detailed questions to gain a better understanding of why they left. And you don’t need to spend thousands or have special technology. Reasonably priced online tools, such as SurveyMonkey, Typeform, and Google Forms, make the survey process inexpensive and straightforward. And don’t worry about bothering your customers. Most Club members appreciate being asked for their opinions and are often willing to participate, particularly if their time is acknowledged with a small incentive.

Hiring a Database Firm

But what if you’re seeking feedback from people beyond your existing customer base—perhaps to test new packaging, a label redesign, or a potential ad campaign? In such cases, a winery may turn to a specialized form of primary research known as panel research. You need to work with an outside research firm for this, but it is still considered primary research because the questions pertain exclusively to your brand and objectives, whereas secondary research is universal.

You want to look for a research firm with a verifiable, recent, and active panel. (A panel is the group of respondents). You will provide them with demographic, geographic, and some behavioral criteria, and they should be able to confirm that they can deliver that audience for your survey, as well as provide a count of how many are available. For instance, in a research study we recently conducted for a large Carneros winery, we asked for 35-55-year-old males and females, US residents, who drank sparkling wine at least twice a month. Scrutinize the criteria and results as you are paying a research firm to supply an accurate and qualified panel. They will also post the survey and deliver the results to you but will not typically get involved in your questionnaire, targeting, or analysis.

These firms maintain databases of vetted individuals who meet specific criteria and are compensated for their participation in the program. This path is far more reliable than crowdsourcing feedback online on a platform like Meta, where individuals may misrepresent themselves to access incentives.

The number of respondents needed for an accurate survey is a complex calculation involving the total population size, the degree of error you’re willing to accept, and how many standard deviations your data is from the mean. So rather than getting into that, a rule of thumb is 1100 gives most populations a degree of error of +/- 3%, which is typically acceptable.

To get 1,100 responses, you’ll need to ask between 6,000 and 8,000 people; however, as a standard survey response rate is 20-30%. Since you only pay for respondents, asking for much more than you need is a way to ensure you get the count you’re looking for. You can always shut the survey off when you reach your desired count.

The downside, of course, is cost. Panel-based research typically starts at $10,000 and increases depending on the scope and specificity of your target audience. This figure does not include incentive payouts, which often start at $10 per respondent and increase for harder-to-reach segments, such as high-income households with established cellars versus college-aged consumers new to the wine category.

Regardless of whether you collect your data internally using platforms like SurveyMonkey or hire a professional firm to run a panel, there are several best practices to keep in mind when designing your survey:

Best Practices for Survey Design

1. Define a clear, attainable goal.

Rather than beginning with a vague goal like “I want to understand why my wine isn’t selling,” refine your objective into something more focused and actionable, such as: “I want to identify the main factors causing customer attrition and determine whether these are internal (e.g., service, price, experience) or external (e.g., economic pressures, changing preferences).”

2. Save personal and demographic questions for the end.

Asking for age, gender, income, or race is important in any study. But if you ask for these data points at the start of a survey, you may discourage participation. Place these questions at the end, after trust has been established. Also, when requesting demographic data, be respectful and inclusive in your approach. For gender, allow options beyond the binary, such as “Male,” “Female,” “Non-binary,” and “Prefer not to say.” For race or ethnicity, use standardized language (as found in census or government forms), and always include an “Other” or “Prefer not to say” option.

3. Keep your survey concise.

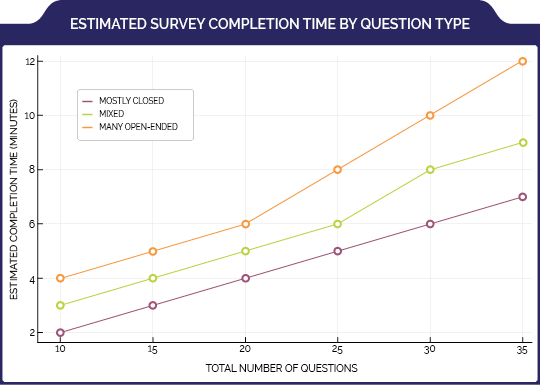

Respondents can typically answer 3 to 5 questions per minute, depending on complexity. Aim to keep your survey under 5 minutes, which translates to approximately 15 to 25 questions in total. Surveys that exceed 10 minutes often see significant drop-off rates, particularly when taken on mobile devices. To improve completion rates, prioritize only the most essential questions and limit the number of open-ended responses.

4. Prioritize closed-ended questions.

Offer structured choices that are easy to quantify and evaluate. For example, instead of asking, “How do you feel about our tasting experience?” you might ask, “How would you rate your last tasting experience?” with options ranging from “Excellent” to “Poor.” Open-ended questions where write-in responses are gathered can yield valuable insights, but they are challenging to review quantitatively.

5. Consider offering an incentive.

Even small gestures improve response rates. Currently, a modest thank-you gift, such as branded merchandise or a tasting coupon, is standard. For larger studies or panels, a sweepstakes or drawing entry can be an effective approach, provided it complies with local laws. Remember that it is illegal in the US to give alcohol as an incentive.

6. Avoid leading questions.

Your wording should not nudge the participant toward a specific answer. A question like “How helpful were our friendly customer service representatives?” assumes a positive experience. A more neutral version would be, “How would you rate your interaction with our customer service team?”

7. Steer clear of absolutes.

Questions that use absolutes, such as “always” or “never,” can distort results. For example, “Do you always enjoy the choices of wine in your wine club shipment?” leaves little room for nuance. A better phrasing might be, “How often do you enjoy the choices of wine in your wine club shipment?” with options that include “never, rarely, about 50/50, most of the time, always”.

8. Use balanced answer choices.

Avoid answer scales that are skewed in either a positive or negative direction. For example, a scale that includes only “Very helpful,” “Helpful,” and “Neutral” lacks balance. A more comprehensive version would consist of the following options: “Very helpful,” “Helpful,” “Neither helpful nor unhelpful,” “Unhelpful,” and “Very unhelpful.”

9. Avoid double-barreled questions.

These are questions that ask two variables in one question, making it difficult for respondents to answer accurately. For example: “How would you rate our customer service and wine selection?” You will receive better insight if this thought is separated into two distinct questions.

10. Ask your most important question in more than one way.

To ensure clarity and consistency, consider approaching key topics from multiple angles. For instance, ask the question:

What is the single most important reason you joined our Wine Club?

☐ Events ☐ Discounts ☐ Free tastings ☐ First access

Later in the survey, also include the question;

Rate the following Wine Club benefits from 1 (least important) to 4 (most important):

☐ First access ☐ Free tastings ☐ Discounts ☐ Events

Conducting your consumer research can be one of the most powerful tools in your marketing toolkit. Whether you’re surveying your wine club to refine benefits, exploring new packaging concepts through a consumer panel, or simply testing assumptions about your audience, primary research grounds your decision-making in evidence rather than instinct. While it requires time, careful planning, and sometimes financial investment, the payoff is clear: better alignment with your customers and stronger, more sustainable marketing strategies.

If you’re interested in learning more about your audience, please reach out, and we’ll be happy to help you put together your own research to find some answers.