Less Visitation to Wine Country

Why Less Visitation to Wine Country Is Everyone’s Problem

Wineries with tasting rooms know all too well that foot traffic is shrinking. But it was our clients without a hospitality arm who got us thinking: how important is the on-site channel to the wine industry as a whole?

Maybe we’re just evolving. After all, people buy everything—from cars to carrots—online these days. Isn’t it natural for wine to follow suit?

We pulled on that thread, and it turns out the decline in wine country tourism is a bigger issue than it first appears.

What Is the Problem?

When we look at why wine sales are down, we can break it into three core factors:

- Frequency

- Volume

- Abstinence

And one of those clearly dominates.

Frequency—how often someone chooses wine—is the elephant in the room. It accounts for a whopping 65% of the volume decline. Simply put, fewer people are reaching for wine in their daily lives.

Next up is volume, responsible for about 19% of the drop. These consumers still drink wine, but they’re drinking less per occasion.

Finally, abstinence represents only 7% of the decline. These folks have exited the wine category altogether, often favoring spirits, RTDs, or non-alcoholic options.

This breakdown gives us a clear direction: focus on increasing frequency, encourage responsible volume, and work to keep existing wine drinkers from drifting away.

Who Is the Problem?

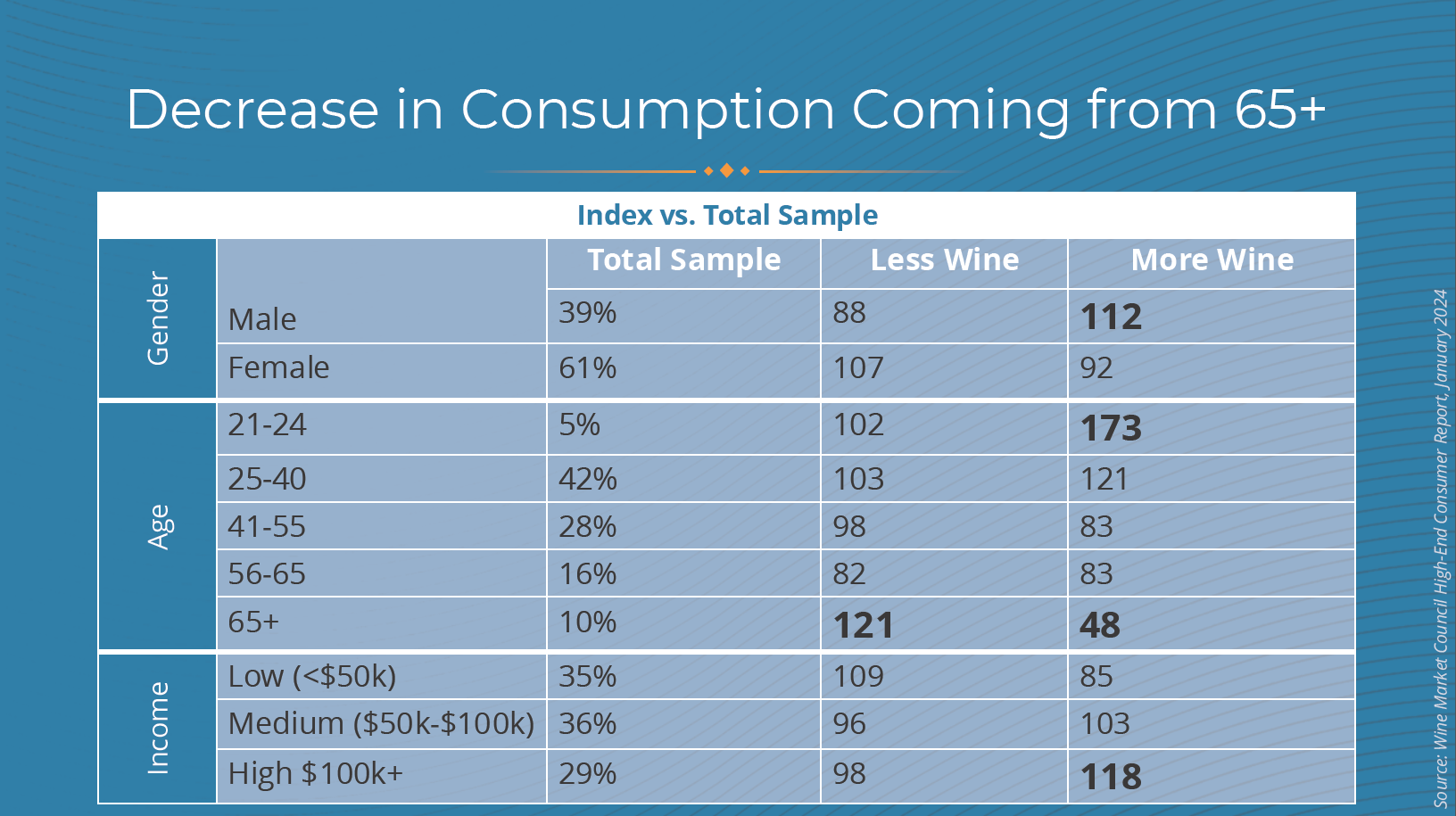

Demographic data shows us where the decline hits hardest—and where there’s still potential.

Let’s start with age. Younger drinkers (ages 21–24) are actually increasing their wine consumption—by 73% more than any other age group. Meanwhile, drinkers aged 65+ are leading the retreat, with an index of 121 for drinking less and just 48 for drinking more. This could be due to health concerns, lifestyle shifts, or simply changing preferences.

Income tells a similar story.

Low-income consumers (<$50k) are more likely to be drinking less wine. On the other hand, higher-income consumers are still spending—often on premium bottles—indicating the luxury wine segment remains strong.

So if we’re looking for growth, it’s clear: the opportunity lies with younger, affluent consumers who are curious and still forming their wine habits.

How Do We Encourage Premium Wine Purchase?

Across the board, consumers who begin buying wine over $20 didn’t just wake up one day and change their habits. They were introduced to a gateway wine—a bottle that surprised and impressed them, often in a memorable setting.

That single bottle becomes a turning point. From there, consumers often start exploring more expensive options, seeking wine education, and becoming more involved in wine culture.

Creating that moment is the key. The industry’s challenge is to get more consumers to cross that threshold.

Where Do These Gateway Moments Happen?

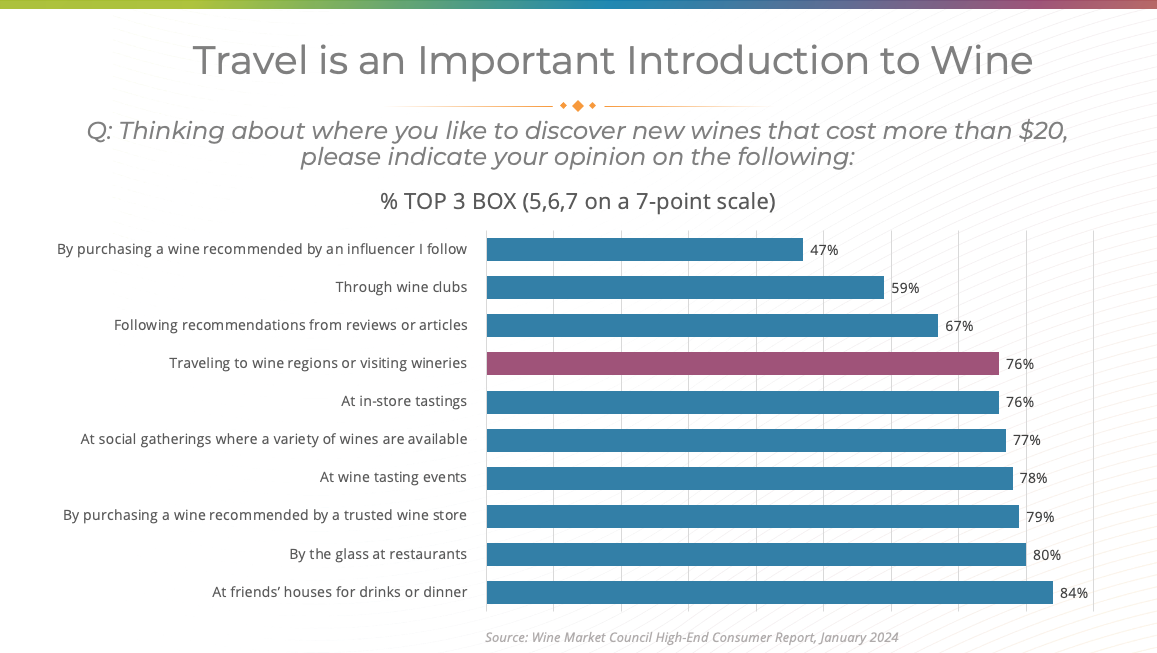

According to the Wine Market Council, the most common place consumers discover wines over $20?

Wine country.

A full 76% of consumers say visiting a winery or wine region plays a role in their discovery of premium wines. The physical, sensory, and emotional experience of being on-site is nearly impossible to replicate online.

Social gatherings, tastings, and trusted retailers also matter—but in-person, immersive experiences lead the charge. More passive methods like influencer content or wine club shipments don’t seem to have the same effect.

The takeaway? Wine isn’t just a product. It’s an experience—and wine country is still the best showroom we have.

Why This Matters

Our biggest opportunity lies with converting curious, affluent younger consumers into wine lovers—and eventually, loyal buyers. To do that, we need to get them into wine country.

Research consistently shows that visiting wineries increases consumers’ exposure to higher-end wines and reinforces a lifestyle that includes wine. And that lifestyle leads to stronger engagement, deeper knowledge, and more frequent purchases.

But Here’s the Catch

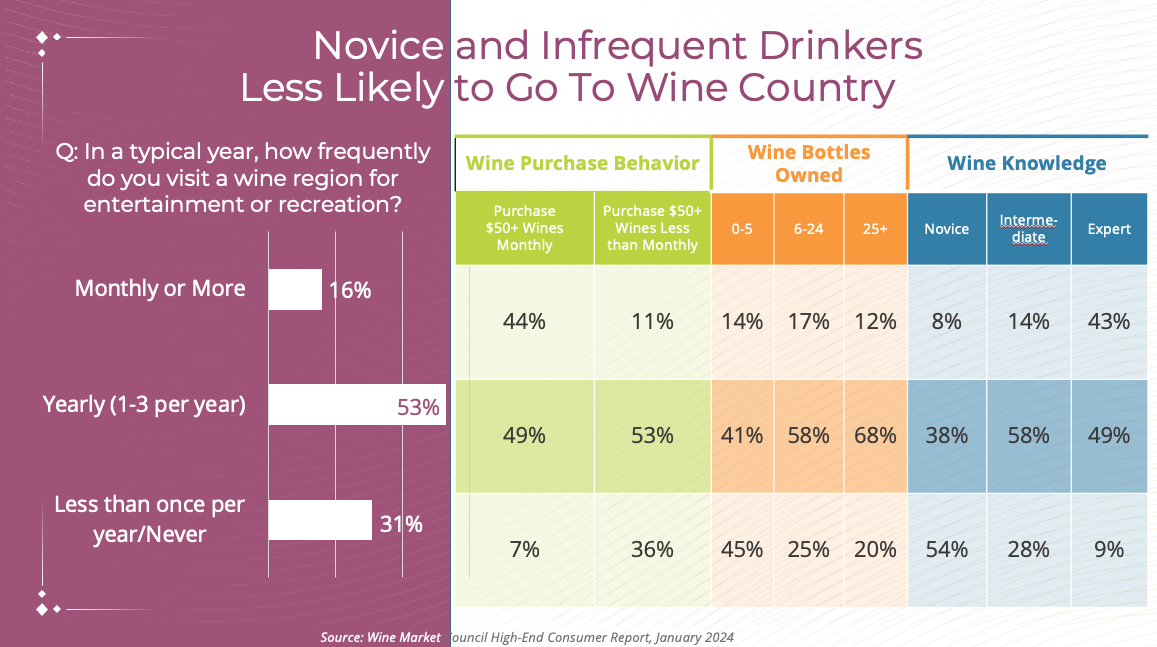

Only 16% of consumers visit a wine region monthly or more—and most of them are already wine lovers.

Another 53% visit once to three times a year.

And 31% of consumers visit less than once a year or never.

That last group is where the biggest opportunity lies—and also our biggest challenge.

Novice wine drinkers make up 54% of those who rarely or never visit wine country. These are exactly the people we need to reach if we want to grow the category long-term.

The most engaged wine tourists?

- People who buy $50+ wines

- Those who own 25+ bottles

- Wine experts

The least engaged? Newcomers.

This leaves us with a critical challenge: How do we attract novice drinkers and infrequent buyers to wine country in the first place?

What Now?

To grow our consumer base, wineries must take this data seriously. That means:

- Lowering the barriers to entry with more accessible, welcoming, and inclusive experiences

- Designing immersive, unforgettable visits that educate and inspire

- Investing in storytelling, hospitality, and connection—the things that can’t be bottled, boxed, or shipped

In Summary

The decline in wine country visitation isn’t just a hospitality problem—it’s a brand engagement crisis. If fewer people are stepping into our world, fewer people are falling in love with wine. And that affects the entire industry, from DTC to wholesale.

We need to rethink the winery experience, not as a bonus channel, but as the first step in a consumer’s lifelong journey with wine. The more gateways we build, the more drinkers we gain—and the better chance we have at making wine culture thrive for generations to come.