We’re going to share with you how to handle Bank Reconciliation for QuickBooks Desktop and break out the process with each supported eCommerce Platform.

Commerce7

eCELLAR

vinSUITE

WithWine

WineDirect

Commerce7

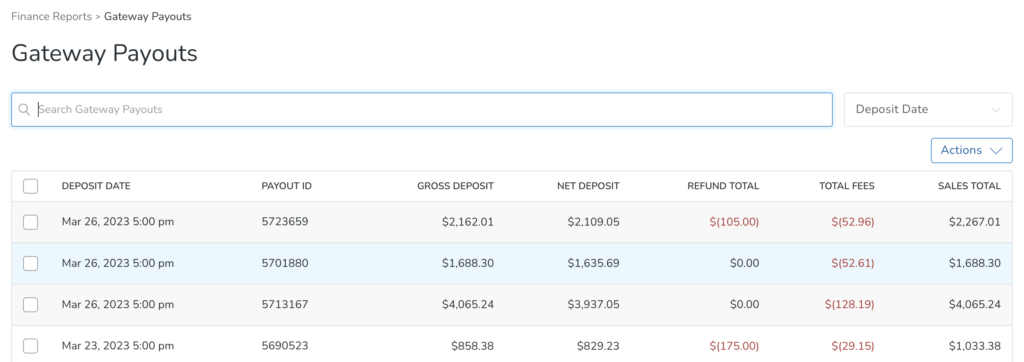

Step 1: Head to Reports > Finance Reports > Gateway Payout Report

Step 2: Choose the date range of transaction dates you wish to reconcile

The Gross Deposit is what matches the total in QuickBooks.

The Net Deposit is what went into the Bank.

Refunds will match any Credit Memos that went into QuickBooks.

The Total Fees are the fees subtracted before the money is deposited into the Bank.

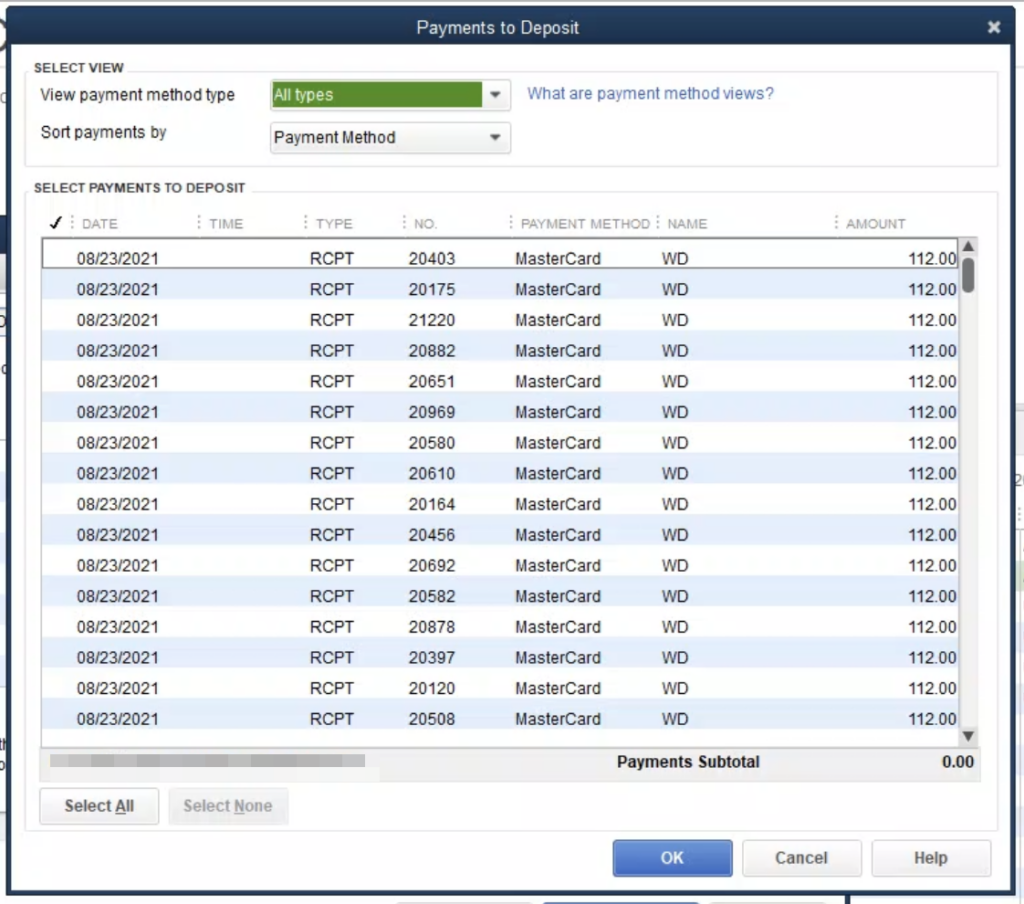

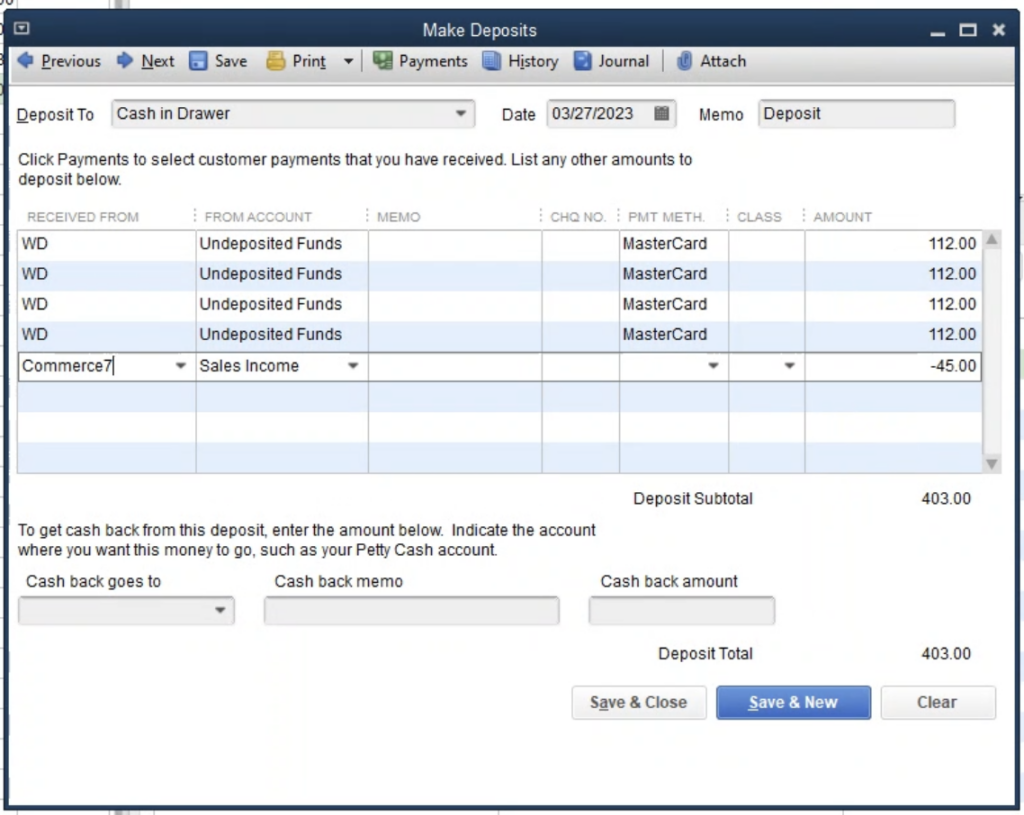

In QuickBooks, when you are in the Make Deposit screen, select your orders for this date range.

The number will match your Gross Deposit amount. To match your bank, add the Merchant Fees as subtractions from the Deposit. You can add a Memo to these orders such as “C7 Merchant Fees”.

The Deposit Subtotal will match your bank deposit.

If you are having a hard time matching your deposit to the amount of money you’re trying to reconcile to in QB, then it might be due to when the Gateway batches happen.

Batches with FullSteam (Commerce7) happen at around 5 pm PST every day. This is unable to be changed as of April 2023. This will likely result in batches containing orders from different days. Learn More

Ie. if an order was placed after 5 pm on January 1st, it will appear with the January 2nd orders placed before 5 pm in the same batch. You will still be able to reconcile your transactions despite this fact, it will just take a little extra bit of digging.

eCELLAR

Step 1: Head to your Company Reports > Finance Reports

Step 2: Search for your desired date range

Step 3: Open the Report

The revenue on this report will match what is in QuickBooks.

From here, you will be able to reconcile your bank deposit.

vinSUITE

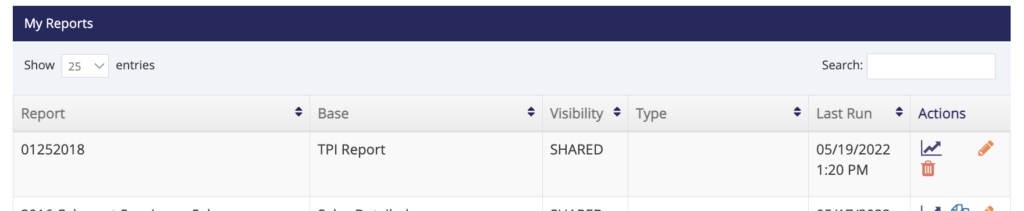

Step 1: Head to reports > create a custom report that uses the TPI Report Base or use an existing financial report of your choosing.

Step 2: Select your desired date range.

Step 3: Open the Report

The revenue on this report will match what is in QuickBooks.

From here, you will be able to reconcile your bank deposit.

WithWine

Step 1: In the Orders section, adjust your filters to show the orders and the date range you wish to obtain.

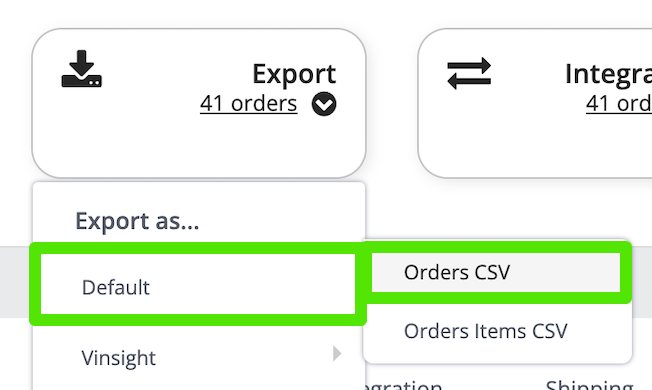

Step 2: Then choose to export the orders with the Default option > Orders CSV

Step 3: Download the export file.

Highlight the rows for the specific date ranges you wish to reconcile.

From here you will be able to highlight the appropriate rows to identify and reconcile your bank deposit.

WineDirect

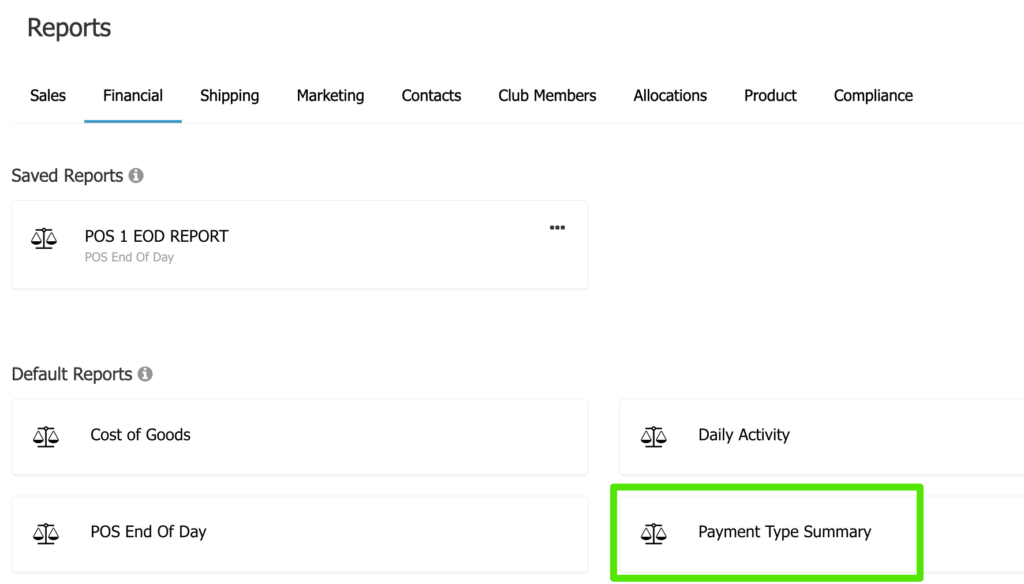

Step 1: Go to Reports > Financial > Payment Type Summary Report

Step 2: In this report, choose the date range you need.

Step 3: Either view the previewed report or the downloaded one.

From here you will be able to match the revenue in WineDirect with QuickBooks and your Bank Deposit.

Gateway Batch times

In some cases, you can ask a Gateway to change its batch times to midnight. Other times, this will not be possible. Why would a gateway need to do its batches during business hours and not at midnight?

Payment gateways process transactions at various times throughout the day based on several factors, including the time zone of the gateway, the policies of the payment processor, and the needs of the merchants using the gateway.

There are a few reasons why payment gateways process transactions during business hours rather than at midnight:

- Security: Payment processors need to ensure that transactions are secure and accurate, which can require manual intervention and oversight by staff. Processing transactions during business hours allows payment processors to have staff on hand to handle any issues that arise.

- Merchant needs: Many merchants need to receive funds quickly in order to maintain their business operations. Processing transactions during business hours ensures that merchants can receive their funds as quickly as possible. Processing a batch at midnight delays this by at least an extra day.

- Banking hours: Banks, which are often involved in payment processing, typically have business hours that are consistent with standard business hours. Processing transactions during business hours allows payment processors to work within the banking system’s business hours.

While processing transactions at midnight may be convenient for most businesses, it may not be feasible or practical for payment gateways to do so. Ultimately, the timing of payment processing is determined by a variety of factors, and payment processors will strive to balance the needs of their customers with the practicalities of their operations.